View or Pay Your Taxes/Utility Bill Online

The City offers residents and businesses the option to pay tax and utility bills online.

Online payment options include:

- E-check - use of an electronic check (e-check) drawn from a checking account will incur a flat fee of 95 cents. A fee of $20.00 will be charged for any electronic check payment that is returned for any reason. This fee cannot be waived.

- Tax Payments using a charge/debit card - Effective March 26, 2023, there is a convenience fee of 2.99% of the payment amount with a minimum charge of $3.95. This is for taxes, not water/sewer. The City receives only your bill payment amount. *Convenience fees are set by the payment processing company and cover various administrative costs associated with accepting payments and are non-refundable.

- Water/Sewer payments by credit card - there is a fee of $6.95 for amounts up to $400. Bills over $400 require multiple transactions.

CHOOSE ONE OF THE FOLLOWING TO PAY ONLINE:

* The convenience fee amount is automatically calculated and is shown on the payment page before you submit your payment for processing. Convenience fees will appear as a separate charge from the bill amount on your bank or credit card statement.

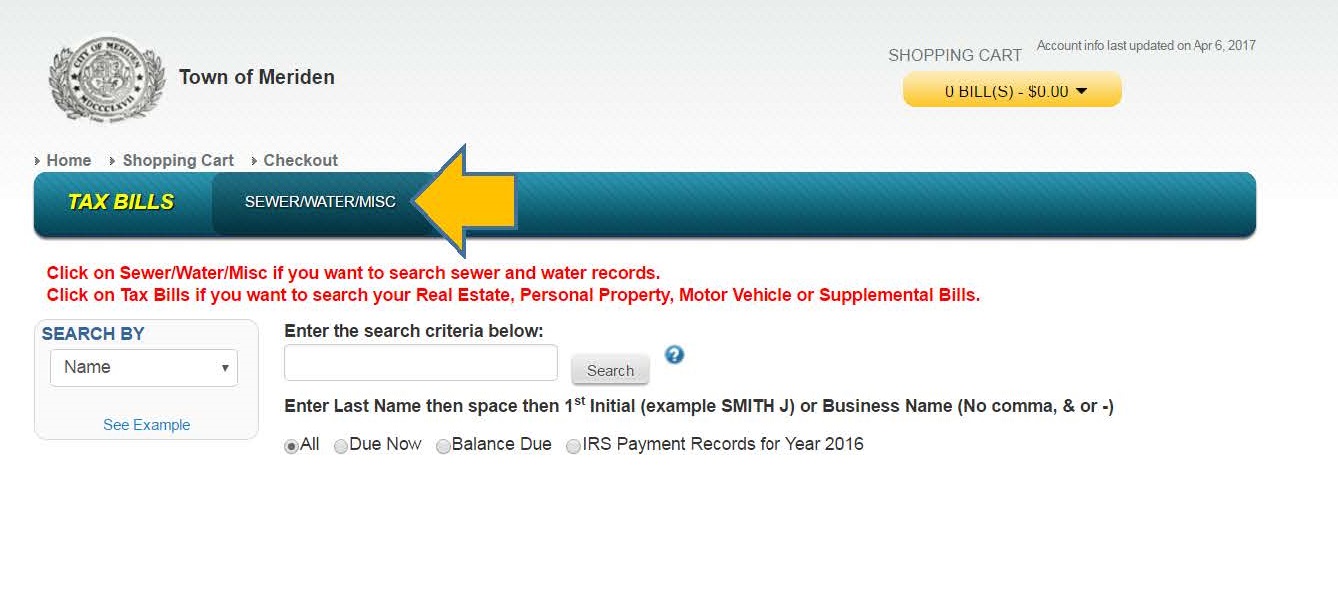

Instructions

- Enter your Unique ID which is the six (6) digit "Bill #" located on your quarterly bill.

- Click "Search" and a listing of your bills will appear.

- Click on the box on the right of the bill you wish to pay. Once you have selected the bill(s) for payment click on the yellow box under "Shopping Cart" in the top right corner of the page and click "Checkout".

- Please read the terms and conditions prior to completing the payment process.

WHERE DO MY TAX DOLLARS GO?